Insurance companies in Pakistan play a crucial role in providing financial security and risk management solutions to individuals and businesses. These companies offer a wide range of insurance products, including life, health, property, and automobile insurance, among others.

The insurance industry in Pakistan is regulated by the Securities and Exchange Commission of Pakistan (SECP), ensuring compliance with legal and ethical standards. Several prominent insurance companies operate in the country, offering diverse coverage options and tailored policies to meet the needs of the population.

Life insurance policies are popular, serving as a means of safeguarding families against uncertainties. Health insurance is also gaining traction, offering medical coverage to individuals and families, reducing the burden of healthcare expenses. Property and automobile insurance contribute to protecting assets against potential losses due to accidents, theft, or damage.

Insurance companies in Pakistan have been gradually embracing technology to streamline operations and enhance customer experience. Online platforms and mobile apps are becoming more common for policy purchase, claims processing, and customer support.

However, challenges such as low insurance penetration, lack of awareness, and concerns about fraudulent practices still persist. Efforts are being made to increase public awareness about the importance of insurance and its benefits in mitigating financial risks. As the Pakistani economy grows and awareness spreads, the insurance industry is expected to continue evolving, offering greater security and stability to individuals and businesses alike.

There are many insurance companies in Pakistan, but just a few stand out as market leaders. These businesses have developed a solid reputation for providing dependable customer service, extensive coverage options, and sound financial standing.

Top 10 best insurance companies in Pakistan are:

State Life Insurance Company of Pakistan, founded in 1972, is Pakistan’s largest and best life insurance firm. As a government-owned enterprise, it offers a wide range of best insurance products and services, including individual life insurance policies, group life insurance schemes, pension plans, and health insurance. The company aims to provide financial stability and protection to policyholders and their families in case of unforeseen occurrences.

With a nationwide largest network of regional offices, zonal offices, and branches, State Life provides customer service and policy-related operations. The company employs numerous insurance agents to assist consumers in understanding various plans and selecting the best solutions based on their needs.

State Life is known for its commitment to client satisfaction, dependability, and ethical standards, and has received numerous honors and recognition for its services in the insurance market.

One of the best Jubilee Life Insurance Company Limited was established in Pakistan on June 29, 1995, as a Public Limited Company under the Companies Ordinance, 1984. The company’s registered offices are in Kashmir Plaza, Jinnah Avenue, Blue Area, Islamabad, and Jubilee Life Insurance Building, 74/1-A, Lalazar, M. T. Khan Road, Karachi. The name Jubilee Life Insurance was chosen after extensive investigation, as it is well-known in the financial services industry and is related to “Happy.” The company aims to provide market presence and help customers plan and achieve their financial goals, ensuring their happiness and satisfaction.

Jubilee Life operates non-participating life insurance and has created Shareholders’ funds and statutory funds for each class of its life insurance business, in compliance with the Insurance Act, 2000. JCR-VIS Credit Rating Co. Ltd. has awarded Jubilee Life an Insurer Financial Strength (IFS) rating of “AA+” with a stable outlook. The company is owned by Aga Khan Foundation for Economic Development S.A. Switzerland.

Jubilee Life launched Window Takaful in 2015, offering Shariah-compliant products to help individuals cope with uncertainties. The company’s in-house Shariah Compliance Department and external audits ensure compliance.

Company is Verified from;

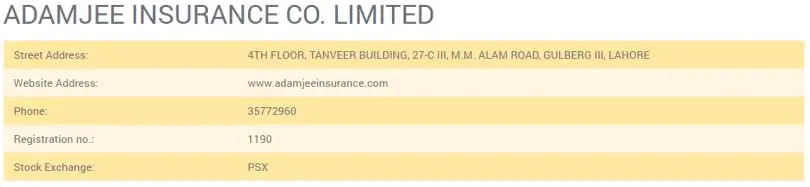

Adamjee Insurance Company Limited (AICL) is a major general best insurance company in Pakistan, founded in 1960 and listed on the Pakistan Stock Exchange Limited. With a regional presence in the UAE, AICL maintains a competitive edge through its paid-up capital and reserves, as well as a diversified business portfolio. The company offers a range of insurance products and services, including motor, fire, marine, health, travel, property, and liability insurance.

AICL has a large network of branches throughout Pakistan and a global presence through their reinsurance business. The company prioritizes customer happiness and provides timely and efficient service, with a specialized customer care staff handling policy issues. AICL’s financial strength and industry recognition demonstrate their dedication to quality and expertise in the insurance sector.

Company is verified from:

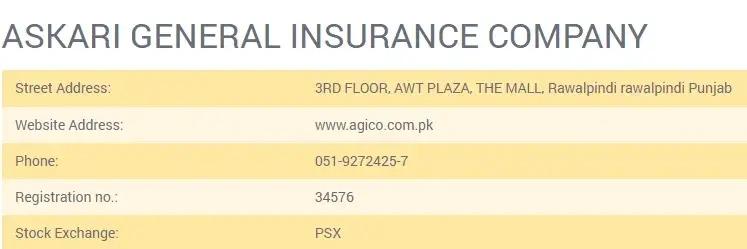

Agico, founded in 1995, is a Pakistan Stock Exchange-listed Public Limited Corporation (PLC) with a focus on client-centric approach. The company’s success is not solely attributed to annual profits or business coverage. The workforce’s collaboration, trust, and respect have enabled Agico to meet and exceed clients’ expectations.

The company is involved in Pakistan top level CEPEC projects, including the Ultar, CR20G, DASU-LRBV-11, HUBCO Energy project Terbela-4, Karachi Lahore Motorway, Kararot Hydro Power project, CLIC DASU-LRBV-12, DASU Hydropower, Yantze Three Gorges, Kohala Hydro Power project, Suki Kinari Hydro Power project, and Neelam Jhelum Hydro power project.

Company is verified from;

EFU General Insurance Ltd, Pakistan’s largest and oldest best general insurance firm, has been providing superior service since 1932. With a diverse client base, EFU covers various risks, increased competence, and delivered on commitments. In 2017, the firm surpassed the Rs.20 billion premium/contribution mark, becoming the first general insurance firm in Pakistan’s history to do so. EFU General offers a comprehensive range of insurance services, including Fire, Engineering, Maritime, Aviation, Motor, Miscellaneous, and Takaful (Islamic Insurance) coverage.

It has been ranked by national and international rating agencies, with VIS and PACRA granting AA+ ratings with stable outlooks and AM Best providing B ratings with stable outlooks. EFU General has achieved ISO 9001:2015 certification.

It has received numerous awards for its contributions to Pakistan’s industry and economy, including the Corporate Excellence Award of the Management Association of Pakistan, the Best Corporate Report Award of the Institute of Chartered Accountants of Pakistan, the Achievement Award and Gold Medal of the Federation of Pakistan Chambers of Commerce and Industry, and the SAFA Best Corporate Report Award. EFU General is Pakistan’s most powerful trusted brand and top insurer of Chinese infrastructure projects (CPEC).

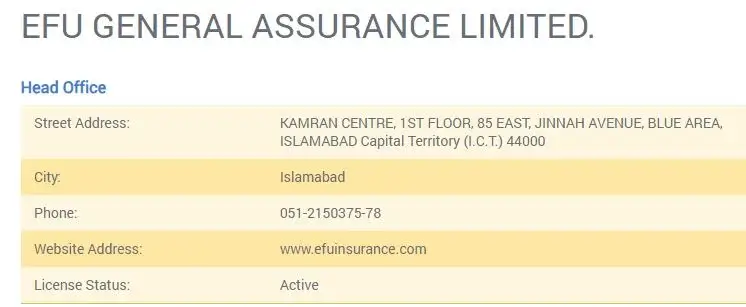

EFU General Insurance is verified from:

Shaheen Insurance, a Pakistan Air Force-sponsored project of the Shaheen Foundation, was established in 1996 as a public limited company. With a paid-up capital of 20 million rupees, the company has grown to 600 million rupees in a short span of time it has emerged as one of the best insurance provider and has a strong equity base.

The Shaheen Foundation, a significant shareholder, is interested in managing the company’s strategy and creating long-term plans. Shaheen Insurance has established itself as a reputable insurer in Pakistan, offering reasonably priced insurance from Mexican providers. The company’s close-knit team provides personalized and excellent services to its esteemed customers.

Crown Window Takaful Operations and Shaheen Window Takaful Operations are insurance companies based on SECP’s Takaful Regulations. Shaheen has an “A” grade from PACRA and is a subsidiary of the Pakistan Air Force-owned Shaheen Foundation. The management team is dedicated to takaful and ethical standards.

Company is verified from following site

Reliance Insurance was founded in 1981 as a public limited company and listed on the Pakistan Stock Exchange. The company is also registered with the Central Depository Corporation of Pakistan Ltd. (CDC) and operates in the general insurance industry among top other in this sector.

Since its inception in 1981, Reliance Insurance has established itself as one of the most recognized and best brilliant brands in the insurance industry, and its persistent expansion has earned it a place among Pakistan’s major insurers.

Reliance Insurance is jointly owned by the Al-Noor Group and the Amin Bawany Group, both prominent manufacturing firms in Pakistan.The Al-Noor Group, led by Chairman Ismail H. Zakaria, includes Al-Noor Sugar Mills, Shahmurad Sugar Mills, First Al-Noor Modaraba Company, and Noori Trading Company.

The Bawany Group, founded by Amin Ahmed Bawany, includes Faran Sugar Mills, Ayesha Bawany Academy, Unicol Limited, Second Particle Board Mills, and B.F. Modaraba Ltd.

Company is verified from,

The United Insurance Company of Pakistan Ltd was founded in 1959, with over 100 branches in East Pakistan (now Bangladesh). It is a limited liability company traded on the Pakistan Stock Exchange and has a diverse board of directors. Established by industrialist Fakhruddin Valika, the company initially offered general insurance and life assurance.

It had a wide network of branches in West Pakistan and East Pakistan, and conducted specialized insurance in engineering, marine, aviation, hail storms, and loss of profits. The Valikas relinquished their majority ownership in 1982, and Mr. Javaid Sadiq became the company’s chairman in 2017.

With a background in banking, financial institutions, and semi-government autonomies, Mr. Sadiq held important responsibilities during the company’s growth and expanded network making United as of the best public adored insurance company.

Company is verified from,

Crescent Star Insurance Ltd, a registered top best insurer with a paid-up capital of RS 1,077 million, has been raised by Pakistan Credit Rating Agency (PACRA) to “A-” (Single A minus) due to its strong ability to satisfy policyholder and contractual responsibilities.

Established in 1957, the company insures general insurance in Pakistan, including Motor, Health, Fire, Marine, Engineering, Travel, Livestock & Crop, and Miscellaneous. With a strong business team and a branch network, Crescent Star Insurance Ltd caters to clients and stakeholders’ insurance needs.

Company is verified from,

National Insurance Company (NICL) Pakistan, founded in 2000, is a leading top insurance company in Pakistan, offering best services to individuals, corporations, and the government. With a statewide presence, NICL offers a range of insurance products, including motor, fire, marine, health, travel, and miscellaneous coverage.

NICL prioritizes customer satisfaction through prompt and efficient assistance, streamlined claim settlement procedures, and corporate social responsibility. By adjusting to market requirements and embracing technology, NICL contributes to Pakistan’s economic success.

How useful was this post?

Click on a star to rate it!

If you liked this article, then please do share it on the Social Media. If you have a question or suggestion? Then you may leave a comment below to start the discussion.

How useful was this post?

Click on a star to rate it!