Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Rebates have been used to attract consumers or undercut competition since the 1800s. Today, it’s common to see rebate offers on everything from cars to your vacuum-insulated stainless steel tumbler on Amazon. What’s not as common but just as real is a home buyer rebate.

A home buyer rebate can put some money in your pocket when you might need it most, when closing on a home purchase.

In this post, we’ll explore what a home buyer rebate is, how it works, and how you might make it part of your home shopping plans.

Achieve Greater Buyer Confidence With a Top Agent

HomeLight can connect you with the most experienced buyer’s agents in your home shopping area. These top professionals can help you make the best buying decisions and protect your interests.

A home buyer rebate, often referred to as a commission rebate, is a portion of the real estate agent’s commission that’s returned to the buyer at closing. This financial incentive is a way for agents to attract clients in competitive markets by offering a share of their commission as a rebate. While not all agents offer rebates, those who do view it as a compelling way to stand out and provide added value to their clients.

There are some real estate broker companies that have built their entire business model on offering commission rebates.

The process for receiving a home buyer rebate begins when you engage a real estate agent who offers this incentive. Typically, the agent agrees to rebate a portion of the commission they earn from the sale of the home back to you, the buyer.

The exact amount of the rebate can vary and is usually negotiated between the buyer and the agent at the start of their working relationship. In most cases, the agent or broker offers the rebate as a closing credit, meaning that it will reduce the total amount of money you need to complete your home purchase. However, closing credits are subject to a number of terms and restrictions and are subject to lender approval.

They are also not widely available. Unless buyer rebates are built into their business model, many real estate agents and brokers will balk at the idea. In addition, home buyer rebates are not legal in all states (more on this in a minute).

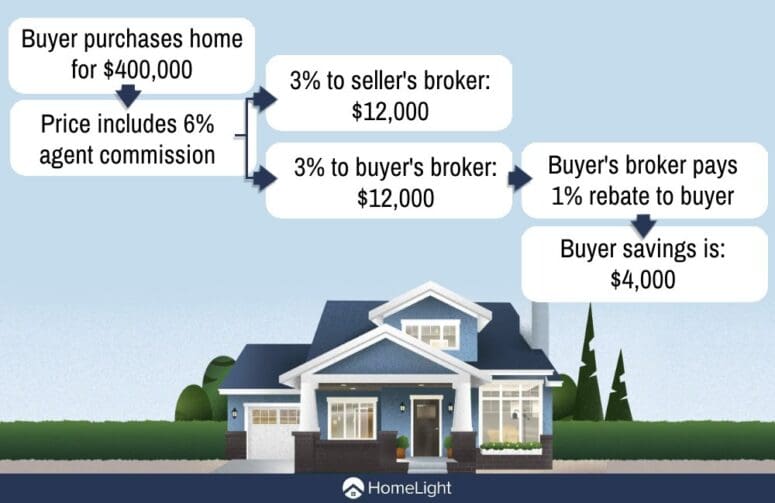

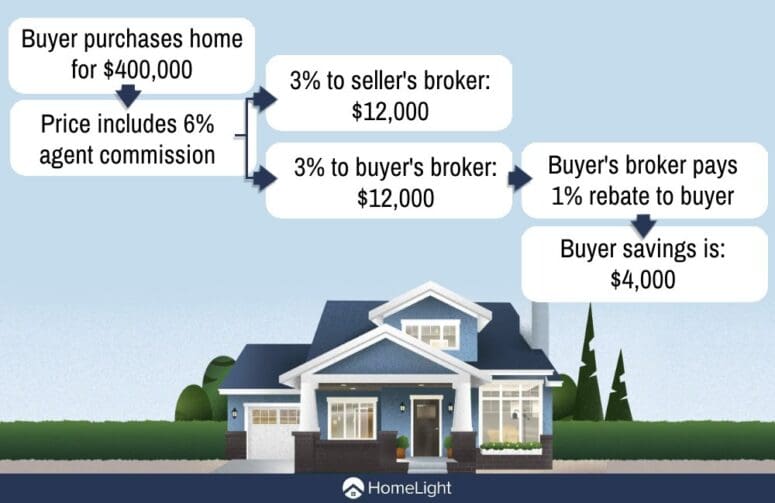

Below are two examples of how a home buyer rebate might play out. For both examples, we’ll base the rebate on the purchase of a $400,000 home.

In this scenario, the rebate is calculated as a percentage of the agent’s received commission. Since real estate commissions are typically a percentage of the sale price (often around 5%-6%, split between the buyer’s and seller’s agents), your rebate could be a portion of your agent’s share. For instance, if the agent agrees to rebate 20% of their 3% commission on a $400,000 sale, you would receive $2,400.

Alternatively, some rebates are based on a percentage of the home’s purchase price. For example, if your agent offers a 1% rebate on a home purchased for $400,000, you would receive a $4,000 rebate. This method is straightforward and allows buyers to easily estimate their potential savings. Below is an infographic to illustrate this second example.

On March 15, 2024, the National Association of Realtors (NAR) announced a landmark lawsuit settlement that will change the way real estate agent commissions are handled in the future. These changes will “decouple” seller and buyer agent compensation and may impact how agents offer buyer rebates. Industry experts predict that this decoupling will likely lower agent fees. Learn more at this link.

Home buyer rebates are legal in most states across the United States, offering a valuable way for buyers to save money on their home purchase. However, there are a few states where these rebates are restricted or not allowed. It’s important to be aware of your state’s regulations regarding home buyer rebates before entering into a rebate agreement with your real estate agent. The nine states that still have laws prohibiting or limiting these rebates include:

*Iowa prohibits rebates when two or more agents are on a transaction.

Before 2005, many states already permitted real estate buyer brokers to share a portion of their commission or fees with their clients. In July 2005, the U.S. Department of Justice (DOJ) won a lawsuit against the Kentucky Real Estate Commission. Part of the settlement agreement made consumer rebates legal in the state. This court action motivated other states to legalize consumer rebates, including Montana, New Jersey, South Dakota, and West Virginia. In December 2021, Louisiana also reversed its ban. Today, 41 states and Washington D.C. allow home buyer rebates.

Because there are ongoing efforts by the DOJ and other groups to make home buyer rebates legal in all states, the list above can change. Consult with a real estate professional or legal advisor in your state to get the most current information.

A couple who bought their first house with no money" width="192" height="108" />

A couple who bought their first house with no money" width="192" height="108" />

Lender approval is necessary for home buyer rebates because the rebate can affect the financial aspects of your mortgage agreement. Lenders need to ensure that the rebate is applied appropriately, either as a credit toward closing costs or deducted from the purchase price, and that it doesn’t impact your loan-to-value ratio in a way that could affect loan approval.

Additionally, lenders must confirm that the rebate complies with federal and state laws, as well as with the policies of the lending institution. This approval process helps protect both the lender and the buyer, ensuring the transaction remains transparent and within legal boundaries.

When you receive a home buyer rebate, it’s important to disclose this in the final Closing Disclosure form under the heading “Other Credits.” This disclosure ensures that all parties involved in the home purchase, including the lender, are aware of the rebate. Proper disclosure also conveys that you are maintaining the legality and transparency of the homebuying process.

While both home buyer rebates and first-time home buyer credits offer financial benefits, they serve different purposes and come from different sources. A home buyer rebate is a portion of the real estate agent’s commission returned to the buyer, often as a negotiation incentive. In contrast, a first-time home buyer credit is typically a government incentive aimed at encouraging homeownership among first-time buyers. This credit might come in the form of tax breaks or direct financial assistance, and eligibility requirements must be met to qualify.

The terms “cash back” and “closing credit” refer to how a rebate is applied at the time of purchase. “Cash back” means the buyer receives a direct payment after closing (in states that allow this). On the other hand, “closing credit” is applied directly to the closing costs of the home purchase, reducing the amount the buyer needs to bring to the closing table. Both methods offer financial relief, but the application and impact on the transaction can differ. It’s important that the rebate method is spelled out in the settlement document.

Agents offer home buyer rebates for several reasons. Primarily, it’s a competitive strategy to attract more clients in a crowded market. By sharing a portion of their commission, agents can differentiate themselves from competitors, offering tangible value to potential clients. Rebates can also foster goodwill and lead to positive referrals, helping agents build their reputation and expand their business. Ultimately, rebates are a marketing tool that benefits both the buyer and the agent.

In most cases, you cannot use your rebate as part of your down payment. Lenders typically require down payments to come from the buyer’s own funds or as a gift from a family member, not from transaction-based rebates. However, a rebate can often be applied to closing costs or might be allowed to buy down the interest rate, indirectly reducing the amount of cash a buyer needs at closing. It’s essential to discuss this with your lender early in the homebuying process to understand what’s possible and ensure compliance with lending guidelines.

The tax implications of a home buyer rebate can be complex and depend on how the rebate is applied and the specific tax laws in place. State tax laws governing rebates also vary. Generally, if the rebate is applied to closing costs or the purchase price, it may not be considered taxable income by the IRS. However, if the rebate is given to the buyer in cash after closing, it could be viewed differently. It’s crucial to consult with a tax professional to understand the tax obligations associated with your home buyer rebate, ensuring compliance with current tax laws and regulations.

Securing a home buyer rebate typically involves a few steps:

Working with a top real estate agent not only increases your chances of securing a valuable home buyer rebate but also ensures you have an expert guiding you through the complexities of the homebuying process. A top agent offers in-depth market knowledge, negotiation skills, and personalized advice, helping you find the right home at the right price — and potentially saving you thousands through a rebate or through expert negotiations.

Remember, the best results come from partnering with a professional who understands your needs and the intricacies of the real estate market. Whether you’re buying or selling — or both — HomeLight can connect you to top agents in your selected market.

Header Image Source: (Jarek Ceborski / Unsplash)

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Share this post